Bl***y Banks Again

+9

Lioned

cherry1

Panda

fuzeta

kitti

Keela

Angelique

Angelina

yask27

13 posters

Page 17 of 37

Page 17 of 37 •  1 ... 10 ... 16, 17, 18 ... 27 ... 37

1 ... 10 ... 16, 17, 18 ... 27 ... 37

Re: Bl***y Banks Again

Re: Bl***y Banks Again

The Regulators must also share responsibility for lax monitoring. Vince Cable was the first , and only Minister to call for a break-up of the Banks, Investment and Retail to be seperated. Gordon Brown made a massive mistake bailing out RBS and Northern Rock. Even placing their own man at the helm, the shady dealing has not stopped. The Government should let RBS go to the wall if any more scandals result in hefty fines.

Panda- Platinum Poster

-

Number of posts : 30555

Age : 67

Location : Wales

Warning :

Registration date : 2010-03-27

Re: Bl***y Banks Again

Re: Bl***y Banks Again

I agree Panda, but there's £Billions missing, millions of jobs lost, companies gone bust, homes repossessed, economies ruined but the bankers are still paying themselves huge bonus payments and doubtlessly many if not most of our MPs are smiling all the way to their offshore banks.Panda wrote:The Regulators must also share responsibility for lax monitoring. Vince Cable was the first , and only Minister to call for a break-up of the Banks, Investment and Retail to be seperated. Gordon Brown made a massive mistake bailing out RBS and Northern Rock. Even placing their own man at the helm, the shady dealing has not stopped. The Government should let RBS go to the wall if any more scandals result in hefty fines.

We plebs are constantly bearing the cost of banking corruption yet the banks NOT the Bankers are paying the fines...The Banks didn't break any laws, they are inanimate objects. The corrupt manipulative Bankers are the criminals, it is they who have destroyed the world economy, yet they do not pay the piper... We do on their behalf.

Whatever Cameron, Cable or the mental dwarf Miliband have to say about regulation, they should ensure that the offenders are taken to task not the bank itself.

malena stool- Platinum Poster

-

Number of posts : 13924

Location : Spare room above the kitchen

Warning :

Registration date : 2009-10-04

Re: Bl***y Banks Again

Re: Bl***y Banks Again

If the truth be known malena, it is the Banks running the Countries , not Politicians. I remember the days when if you wanted to purchase a property , you could only borrow two and a half time your wages. The Banks were lending up to 125% at the height of the Housing boom. Banks just threaten to take their business elsewhere if the Government tries to regulate them , but Sharia Banking , which does not have Investment Banking is very much on the increase and will take over, and I think their method is excellent. If you want to buy a House, instead of the Bank issuing a mortgage, the owner pays rent until the Purchase price is reached and then given the Title Deeds, sensible, no more evictions .

Panda- Platinum Poster

-

Number of posts : 30555

Age : 67

Location : Wales

Warning :

Registration date : 2010-03-27

Re: Bl***y Banks Again

Re: Bl***y Banks Again

There is probably no chance of any new form of banking/mortgage being introduced on a scale large enough to help home buyers, especially if it reduces the profits of the banking community. Sharia banking sounds seriously like an Islamic based system....Panda wrote:If the truth be known malena, it is the Banks running the Countries , not Politicians. I remember the days when if you wanted to purchase a property , you could only borrow two and a half time your wages. The Banks were lending up to 125% at the height of the Housing boom. Banks just threaten to take their business elsewhere if the Government tries to regulate them , but Sharia Banking , which does not have Investment Banking is very much on the increase and will take over, and I think their method is excellent. If you want to buy a House, instead of the Bank issuing a mortgage, the owner pays rent until the Purchase price is reached and then given the Title Deeds, sensible, no more evictions .

malena stool- Platinum Poster

-

Number of posts : 13924

Location : Spare room above the kitchen

Warning :

Registration date : 2009-10-04

Re: Bl***y Banks Again

Re: Bl***y Banks Again

malena stool wrote:There is probably no chance of any new form of banking/mortgage being introduced on a scale large enough to help home buyers, especially if it reduces the profits of the banking community. Sharia banking sounds seriously like an Islamic based system....Panda wrote:If the truth be known malena, it is the Banks running the Countries , not Politicians. I remember the days when if you wanted to purchase a property , you could only borrow two and a half time your wages. The Banks were lending up to 125% at the height of the Housing boom. Banks just threaten to take their business elsewhere if the Government tries to regulate them , but Sharia Banking , which does not have Investment Banking is very much on the increase and will take over, and I think their method is excellent. If you want to buy a House, instead of the Bank issuing a mortgage, the owner pays rent until the Purchase price is reached and then given the Title Deeds, sensible, no more evictions .

Yes it is Islamic , the Muslims do not believe in debt on the scale that the Western World practices. which has resulted in the state we are in now, and quantitive easing is creating more debt.

Panda- Platinum Poster

-

Number of posts : 30555

Age : 67

Location : Wales

Warning :

Registration date : 2010-03-27

Re: Bl***y Banks Again

Re: Bl***y Banks Again

The Muslim world owns most of the worlds fossil fuels and has money to burn, (the rich Muslims anyway) so they have no need to create a debt. However their oil and gas industry will come to an end in the not so distant future and having no other industrial base banking is the best option for them to invest in.Panda wrote:malena stool wrote:There is probably no chance of any new form of banking/mortgage being introduced on a scale large enough to help home buyers, especially if it reduces the profits of the banking community. Sharia banking sounds seriously like an Islamic based system....Panda wrote:If the truth be known malena, it is the Banks running the Countries , not Politicians. I remember the days when if you wanted to purchase a property , you could only borrow two and a half time your wages. The Banks were lending up to 125% at the height of the Housing boom. Banks just threaten to take their business elsewhere if the Government tries to regulate them , but Sharia Banking , which does not have Investment Banking is very much on the increase and will take over, and I think their method is excellent. If you want to buy a House, instead of the Bank issuing a mortgage, the owner pays rent until the Purchase price is reached and then given the Title Deeds, sensible, no more evictions .

Yes it is Islamic , the Muslims do not believe in debt on the scale that the Western World practices. which has resulted in the state we are in now, and quantitive easing is creating more debt.

New Labour certainly created a new phrase with their 'quantitive easing' manatra... It's no more than devaluation and should be called that by the media instead of being spun as the saviour of the UK economy.

malena stool- Platinum Poster

-

Number of posts : 13924

Location : Spare room above the kitchen

Warning :

Registration date : 2009-10-04

Re: Bl***y Banks Again

Re: Bl***y Banks Again

Barclays in crackdown on high pay

Barclays is to rewrite its rules on pay and multi-million pound bonuses in an attempt to drive down costs and stop criticisms that the bank incentivised its executives to take the wrong type of risks.

Hector Sants, the former chief executive of the Financial Services Authority, has been asked to play a key role in writing the new pay strategy, which will be revealed at the bank’s strategic review on February 12. Photo: Justin Sutcliffe

By James Quinn

6:00AM GMT 23 Dec 2012

2 Comments

2 Comments The Sunday Telegraph can reveal that Hector Sants, the former chief executive of the Financial Services Authority, has been asked to play a key role in writing the new pay strategy, which will be revealed at the bank’s strategic review on February 12.

Mr Sants is to join Barclays in January as head of compliance and government and regulatory relations. Last week it was reported that his own remuneration package could be worth as much as £3m.

In his new job, Mr Sants will work with Barclays new chief executive, Antony Jenkins, to reduce compensation levels and change the way in which performance is assessed.

As part of Project Transform, the strategic review Mr Jenkins will announce to investors, the bank will outline a key shift in the way it pays its employees.

Rather than being based solely on financial goals, future payouts will depend as much on the “social impact” of deals signed and products sold.

Related Articles

Barclays slashes bankers' pay by up to a half as profits fall

27 Oct 2012

Barclays boss Bob Diamond nets £17m

09 Mar 2012

Hector Sants to get £3m pay package at Barclays - report

19 Dec 2012

Bold, decisive and imaginative? Barclays' hiring of Hector Sants is none of those things

12 Dec 2012

Barclays names Sants as compliance boss

12 Dec 2012

The change in compensation will form a key part of Mr Jenkins’ plan to show Barclays can be “socially useful”. Mr Jenkins has told colleagues that he wants to rebuild confidence and reshape Barclays’ ethos in the wake of the departure of his predecessor, Bob Diamond, over the bank’s £290m Libor-fixing fine.

Mr Jenkins and his advisers are still working on the final details of how the change in compensation will operate.

However, it is understood that one form of assessment being studied involves giving employees two scores – one based on financial performance, the other based on

performance linked to the bank’s new culture and ethos. Bonuses would only be paid if high scores were delivered on both metrics.

One senior source indicated that such a system would look at “how you delivered” as well as “what you delivered”.

Another source indicated that the scheme would mean that a banker could surpass his or her financial targets but not get a bonus because the person had not “acted responsibly” in reaching the targets.

The new assessment scheme – which it is hoped will be in place for next year’s pay round – will be crafted in conjunction with Mr Sants’ department, which will play an over-arching monitoring role once the scheme is in place.

“Is he going to be personally involved in 150,000 reviews? No. But he will work on the culture and ethos, delivering a different set of criteria on which everyone will be assessed,” said a banking source.

Part of the work conducted by Rich Ricci, head of Barclays investment bank, through his earlier Project Mango review, is thought to have formed the basis of the new assessment plan. Project Mango has now been rolled into Mr Jenkins’ Transform programme, and it is understood Mr Ricci is backing the new chief executive’s desire to reduce pay.

The Sunday Telegraph reported in October that Mr Ricci’s proposals included reducing investment bankers salaries by as much as 50pc in some instances in a bid to cut overall compensation.

The investment bank is a key area for Mr Jenkins, as salaries and bonuses tend to be higher due to the nature of the work and due to past levels of high pay from rival banks.

The bank’s compensation-to-net income ratio stood at 39pc at the end of the third quarter, down from 46pc at the end of last year. It is understood that Mr Jenkins wants to reduce this ratio further, to the mid-30pc mark, within the next two years. His target is believed to remain in the bottom quartile for the investment bank for compensation, signalling that costs will be driven downwards.

News of the desire to drive down compensation comes as it emerged that Fidelity, one of the world’s largest fund managers, which owns a 4pc stake in Barclays, believes management incentives in the banking industry need to be reformed.

Panda- Platinum Poster

-

Number of posts : 30555

Age : 67

Location : Wales

Warning :

Registration date : 2010-03-27

Re: Bl***y Banks Again

Re: Bl***y Banks Again

Doesn't it make you sick, the Head of FSA, who were useless Monitors of the Banks, lands a cushy job at Barclays, one of the worst offenders. !!!!!!

A long time ago it was reported that the Trader at Barclays who made the most money for the Bank in a month was given a Green Card to be spent at a top class Restaurant with a few of his friends , nothing to pay for all night. The total Bill came to over £16,000. At a Bank Seminar I attended many years ago, one of the Speakers said traders operated at such a frenzied pace with split second decision making that they were played out by the time they were 30.

A long time ago it was reported that the Trader at Barclays who made the most money for the Bank in a month was given a Green Card to be spent at a top class Restaurant with a few of his friends , nothing to pay for all night. The total Bill came to over £16,000. At a Bank Seminar I attended many years ago, one of the Speakers said traders operated at such a frenzied pace with split second decision making that they were played out by the time they were 30.

Panda- Platinum Poster

-

Number of posts : 30555

Age : 67

Location : Wales

Warning :

Registration date : 2010-03-27

Re: Bl***y Banks Again

Re: Bl***y Banks Again

These tossers should try doing a real stressful job.Panda wrote:Doesn't it make you sick, the Head of FSA, who were useless Monitors of the Banks, lands a cushy job at Barclays, one of the worst offenders. !!!!!!

A long time ago it was reported that the Trader at Barclays who made the most money for the Bank in a month was given a Green Card to be spent at a top class Restaurant with a few of his friends , nothing to pay for all night. The total Bill came to over £16,000. At a Bank Seminar I attended many years ago, one of the Speakers said traders operated at such a frenzied pace with split second decision making that they were played out by the time they were 30.

malena stool- Platinum Poster

-

Number of posts : 13924

Location : Spare room above the kitchen

Warning :

Registration date : 2009-10-04

Re: Bl***y Banks Again

Re: Bl***y Banks Again

malena stool wrote:These tossers should try doing a real stressful job.Panda wrote:Doesn't it make you sick, the Head of FSA, who were useless Monitors of the Banks, lands a cushy job at Barclays, one of the worst offenders. !!!!!!

A long time ago it was reported that the Trader at Barclays who made the most money for the Bank in a month was given a Green Card to be spent at a top class Restaurant with a few of his friends , nothing to pay for all night. The total Bill came to over £16,000. At a Bank Seminar I attended many years ago, one of the Speakers said traders operated at such a frenzied pace with split second decision making that they were played out by the time they were 30.

malena, you have to blame the Management for making profits the maxim . Time was that Banks were sedate safe places to put one's money. Good management meant shareholders received a dividend or shares in lieu. Then the 70/80's changed all that and we had all these fancy ways derivatives, short selling , subprime mortgages etc so Banks became Casinos. Plus they made loans up to 125% of the value of the property , even to the extent that if the property rose in value of say !0,000, the Bank would let you borrow more money.!!!!!!

I blame the Government as well as the Banks for not monitoring sooner.

Panda- Platinum Poster

-

Number of posts : 30555

Age : 67

Location : Wales

Warning :

Registration date : 2010-03-27

Re: Bl***y Banks Again

Re: Bl***y Banks Again

Time was Panda once the owner of a company had paid all his bills, his workers, himself, his company taxes, dues and demands and had a funds remaining, his firm was in profit and considered to be a fit working concern. Nowadays we see huge combines such as BP posting their quarter accounts and expressing disappointment of only a £400 million profit (for a quarter, not for the year).... So they predict increases of the prices of their goods. The Government don't intervene because they see an increase in companies tax, VAT and fuel tax and the most offensive of all, many of our elected members sit on the boards of these profiteering firms.

The same with banks, they manipulate funds through different accounts, through different banks within their group charging themselves large transfer fees for pushing a button on a PC. If these scams are not illegal, then they should be!

And when these smooth talking, profiteering thieves with their offshore accounts and multimillion pound bonuses are finally caught, their punishment, if any, is a fine paid from the company funds and if they have been really, really naughty they will lose their knighthood and no further invites to the Palace for tiffin... how distressing can that be?

Meanwhile, back in reality... Repossessions, job losses, suicides, food banks and an increase in stealth taxes to pay for increased handouts.

The same with banks, they manipulate funds through different accounts, through different banks within their group charging themselves large transfer fees for pushing a button on a PC. If these scams are not illegal, then they should be!

And when these smooth talking, profiteering thieves with their offshore accounts and multimillion pound bonuses are finally caught, their punishment, if any, is a fine paid from the company funds and if they have been really, really naughty they will lose their knighthood and no further invites to the Palace for tiffin... how distressing can that be?

Meanwhile, back in reality... Repossessions, job losses, suicides, food banks and an increase in stealth taxes to pay for increased handouts.

malena stool- Platinum Poster

-

Number of posts : 13924

Location : Spare room above the kitchen

Warning :

Registration date : 2009-10-04

Re: Bl***y Banks Again

Re: Bl***y Banks Again

Who the Hell gets to see his Bank Manager these days????? The latest move is to do away with cheque books, what about the millions who don't have a Computer.!!

Even this Government, with all the scandals U.K. Banks are involved in , will NOT come down heavy on probity because they are afraid the Banks will go elsewhere.

A long time ago I read a Book by a famous prolific writer, can't remember his name, he served time in Prison .anyway,

Anyway, in the Book , a very poor area in a New York City was promised regeneration if the Council allowed branches to be built in other areas. After the Branches had been built the Bank renaged on it's promise so a kind of Union was formed and people with only a few $ in the Bank would take the money out. Queues formed, everybody taking their money out and there was pandemonium and the run on the Bank threatening to close it down that in the end the Bank caved in.

Maybe we should give these Banks a wake-up call , take our money out and put it in Building Societies until the Banks change their ways.

Even this Government, with all the scandals U.K. Banks are involved in , will NOT come down heavy on probity because they are afraid the Banks will go elsewhere.

A long time ago I read a Book by a famous prolific writer, can't remember his name, he served time in Prison .anyway,

Anyway, in the Book , a very poor area in a New York City was promised regeneration if the Council allowed branches to be built in other areas. After the Branches had been built the Bank renaged on it's promise so a kind of Union was formed and people with only a few $ in the Bank would take the money out. Queues formed, everybody taking their money out and there was pandemonium and the run on the Bank threatening to close it down that in the end the Bank caved in.

Maybe we should give these Banks a wake-up call , take our money out and put it in Building Societies until the Banks change their ways.

Panda- Platinum Poster

-

Number of posts : 30555

Age : 67

Location : Wales

Warning :

Registration date : 2010-03-27

Re: Bl***y Banks Again

Re: Bl***y Banks Again

Would the sort of money the average household has nowadays make blind bit of difference to the banks?

malena stool- Platinum Poster

-

Number of posts : 13924

Location : Spare room above the kitchen

Warning :

Registration date : 2009-10-04

Re: Bl***y Banks Again

Re: Bl***y Banks Again

malena stool wrote:Would the sort of money the average household has nowadays make blind bit of difference to the banks?

Yeah, if everyone took their money out on the same day.!!!!!

Panda- Platinum Poster

-

Number of posts : 30555

Age : 67

Location : Wales

Warning :

Registration date : 2010-03-27

Re: Bl***y Banks Again

Re: Bl***y Banks Again

Shame it can't be organised....Panda wrote:malena stool wrote:Would the sort of money the average household has nowadays make blind bit of difference to the banks?

Yeah, if everyone took their money out on the same day.!!!!!

malena stool- Platinum Poster

-

Number of posts : 13924

Location : Spare room above the kitchen

Warning :

Registration date : 2009-10-04

Re: Bl***y Banks Again

Re: Bl***y Banks Again

I THOUGHT THEY WERE GOING TO KEEP CHEQUE BOOKSPanda wrote:Who the Hell gets to see his Bank Manager these days????? The latest move is to do away with cheque books, what about the millions who don't have a Computer.!!

Even this Government, with all the scandals U.K. Banks are involved in , will NOT come down heavy on probity because they are afraid the Banks will go elsewhere.

A long time ago I read a Book by a famous prolific writer, can't remember his name, he served time in Prison .anyway,

Anyway, in the Book , a very poor area in a New York City was promised regeneration if the Council allowed branches to be built in other areas. After the Branches had been built the Bank renaged on it's promise so a kind of Union was formed and people with only a few $ in the Bank would take the money out. Queues formed, everybody taking their money out and there was pandemonium and the run on the Bank threatening to close it down that in the end the Bank caved in.

Maybe we should give these Banks a wake-up call , take our money out and put it in Building Societies until the Banks change their ways.

Badboy- Platinum Poster

-

Number of posts : 8857

Age : 58

Warning :

Registration date : 2009-08-31

Re: Bl***y Banks Again

Re: Bl***y Banks Again

Not that I know of Badboy, too many people rely on cheques to make payments .

Panda- Platinum Poster

-

Number of posts : 30555

Age : 67

Location : Wales

Warning :

Registration date : 2010-03-27

Deutsche Bank not only involved in LIBOR scandal but now tainting Gold Bars

Deutsche Bank not only involved in LIBOR scandal but now tainting Gold Bars

Source: Deutsche Bank Fulfilled Recent Gold Repatriation Request With Tungsten Salted Gold

November 27, 2012 By The Doc 58 Comments

An Austrian banking source has reportedly claimed that Deutsche Bank ‘fulfilled’ one gold repatriation in recent years with the help of Tungsten and further claims that the tungsten salted gold bars have turned up in Asia.

In 2009, Rob Kirby first uncovered detailed information regarding a massive plot to replace 400 oz good delivery gold bars with highly sophisticated tungsten filled fakes- and even provided evidence that the bars had been swapped with the gold held at Fort Knox.

Widely scoffed at by the financial media in 2009, Kirby appears to have released a Pulitzer worthy story nearly half a decade ahead of its time, as if the Austrian source’s claims are true and Deutsche Bank has in fact fulfilled a recent gold repatriation request with gold plated tungsten, the ramifications are that not only is every single claim made by GATA regarding gold and silver manipulation are 100% accurate, but that real, physical metal is now in desperately short supply and the jig is nearly up for the bullion bank cartel.

This is not 10 small retail PAMP bars found in the Manhattan jewelry district in which a retail jeweler was duped, but a sophisticated con of epic proportions, in which one of the world’s largest bullion banks has reportedly attempted to con a large client.

The Slog reports that at least some of the tungsten tainted gold has now turned up in Asia and that as alleged by Rob Kirby, the source appears to be the US:

This is no small retain scam:

Unlike when Rob Kirby first reported the story in 2009, in the wake of the massive LIEBORGATE scandal, bullion banks fulfilling gold repatriation requests with tungsten salted gold is suddenly 100% believable by the general public.

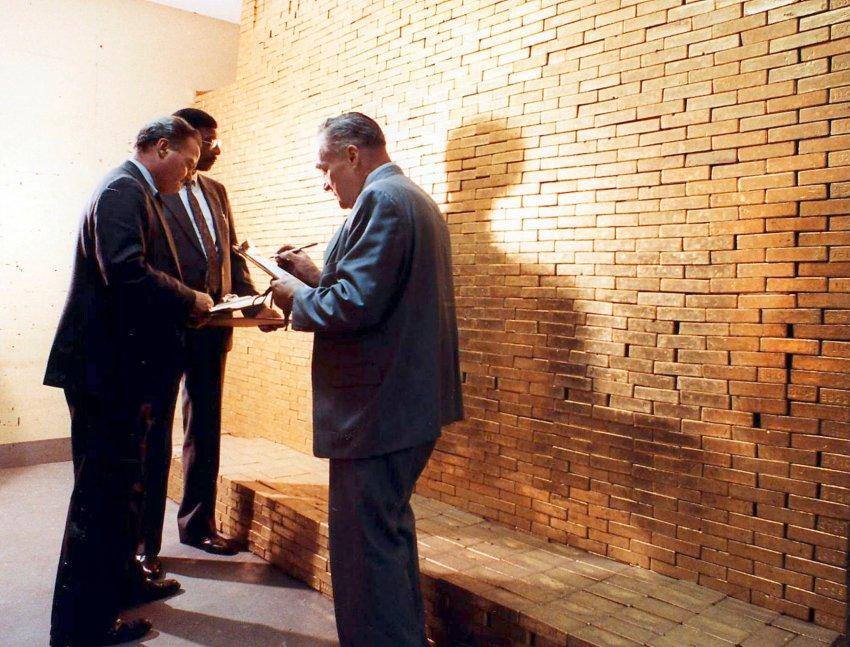

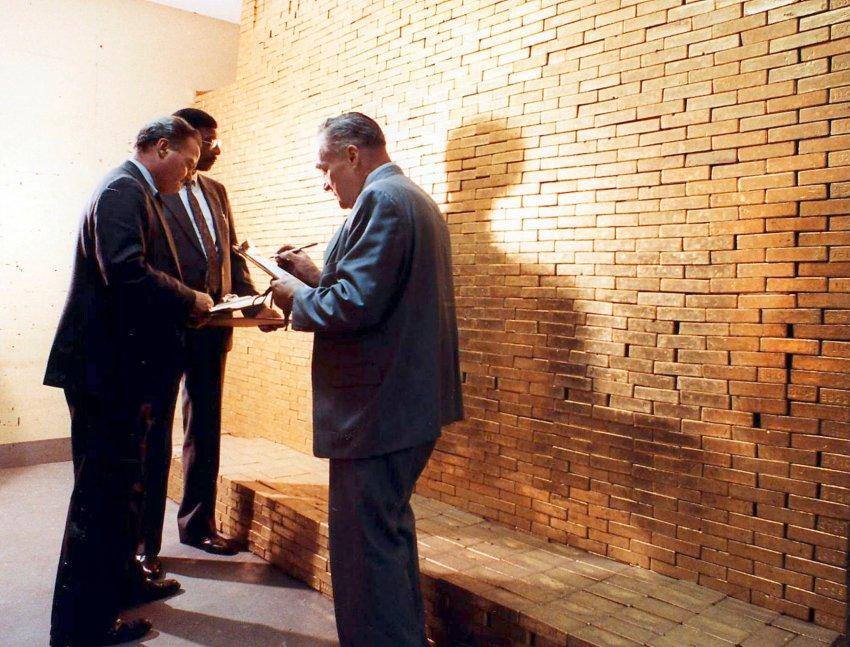

Mr. Chavez, you may want to consider having the subject of your photo-op, as well as your entire 100 tons of gold repatriated in 2011 remelted ASAP. Or, perhaps you are already perfectly aware of this matter and that explains why the tungsten filled bars are suddenly turning up in Asia.

Source: Reuters

No matter, if true and this story gains traction over the coming weeks, the cartel bullion bank gold and silver manipulation is history.

Got REAL PHYZZ?

Check out these similar articles:

November 27, 2012 By The Doc 58 Comments

An Austrian banking source has reportedly claimed that Deutsche Bank ‘fulfilled’ one gold repatriation in recent years with the help of Tungsten and further claims that the tungsten salted gold bars have turned up in Asia.

In 2009, Rob Kirby first uncovered detailed information regarding a massive plot to replace 400 oz good delivery gold bars with highly sophisticated tungsten filled fakes- and even provided evidence that the bars had been swapped with the gold held at Fort Knox.

Widely scoffed at by the financial media in 2009, Kirby appears to have released a Pulitzer worthy story nearly half a decade ahead of its time, as if the Austrian source’s claims are true and Deutsche Bank has in fact fulfilled a recent gold repatriation request with gold plated tungsten, the ramifications are that not only is every single claim made by GATA regarding gold and silver manipulation are 100% accurate, but that real, physical metal is now in desperately short supply and the jig is nearly up for the bullion bank cartel.

This is not 10 small retail PAMP bars found in the Manhattan jewelry district in which a retail jeweler was duped, but a sophisticated con of epic proportions, in which one of the world’s largest bullion banks has reportedly attempted to con a large client.

The Slog reports that at least some of the tungsten tainted gold has now turned up in Asia and that as alleged by Rob Kirby, the source appears to be the US:

A Slog source in Austria is now alleging that Deutsche Bank ‘fulfilled’ one gold repatriation in recent years with the help of Tungsten. He further claims that some of this has now turned up in Asia. Their origin is thought by Beijing to be the United States of America.

This is no small retain scam:

We are talking about an Establishment eurobank alleged to have been caught short on a fulfilment order, and using the tungsten scam to fill the gap.

This is an entirely different criminal intent (from the Manhattan jewelry district discovery): not the somewhat crude attempt to con a retail greenhorn, but rather an well-planned and sophisticated ‘salting’ of the gold bars by a major bank….designed to fool even an expert engaged in approving the purchase for a large sovereign client.

Unlike when Rob Kirby first reported the story in 2009, in the wake of the massive LIEBORGATE scandal, bullion banks fulfilling gold repatriation requests with tungsten salted gold is suddenly 100% believable by the general public.

There is no reason at all for anyone to see this as far-fetched. The SME scams pulled by RBS, and Libor manipulations carried out across the piece of Establishment banking, have been solid evidence in recent times of desperation on the part of those suddenly faced with a brave new world where Berlin wants all its gold back….but the gold isn’t there any more.

Mr. Chavez, you may want to consider having the subject of your photo-op, as well as your entire 100 tons of gold repatriated in 2011 remelted ASAP. Or, perhaps you are already perfectly aware of this matter and that explains why the tungsten filled bars are suddenly turning up in Asia.

Source: Reuters

No matter, if true and this story gains traction over the coming weeks, the cartel bullion bank gold and silver manipulation is history.

Got REAL PHYZZ?

Check out these similar articles:

- 10 More Tungsten-Filled Gold Bars Discovered In Manhattan

- LIEBORGATE Jumps to Germany as Deutsche Bank Probed

- Tungsten Filled 10oz PAMP Suisse Gold Bar Discovered in Manhattan

- German Calls for Gold Repatriation Intensify As Fed Refuses to Allow Inspection

- Banking IT ‘Glitch’ Reaches Germany: Deutsche Postal Bank Halts ATM Transactions

Panda- Platinum Poster

-

Number of posts : 30555

Age : 67

Location : Wales

Warning :

Registration date : 2010-03-27

Re: Bl***y Banks Again

Re: Bl***y Banks Again

German Calls for Gold Repatriation Intensify As Fed Refuses to Allow Inspection

November 22, 2012 By The Doc 92 Comments

Tweet

Calls for Germany to repatriate its 1,536 tons of gold reserves held at the NY Fed are intensifying as Der Spiegel reports the Federal Reserve has refused to allow German inspectors to even view the country’s massive gold reserves “in the interest of security and of the control process“.

Calls for Germany to repatriate its 1,536 tons of gold reserves held at the NY Fed are intensifying as Der Spiegel reports the Federal Reserve has refused to allow German inspectors to even view the country’s massive gold reserves “in the interest of security and of the control process“.

We have stated repeatedly that with repatriation and/or audit requests completed or in progress by Venezuela, Germany, Switzerland, and the Netherlands, The BOE and the Fed suddenly find themselves in a heap of trouble as the situation (and confidence that the Central banks actually still hold the tungsten gold reserves on deposit) is rapidly deteriorating.

More on the Fed’s non-compliance with German requests to view/inspect their own gold below.

Der Spiegel reports that nearly half of Germany’s entire gold reserves are still held (supposedly) 5 floors below the NY Fed:

Of the 9 compartments supposedly storing German gold, German officials were finally allowed to briefly view a few bars from a single compartment in 2011:

Unlike the US financial MSM, the German media is willing to discuss not only the question of whether the Federal Reserve has absconded with Germany’s gold, but also the risk of a collapse of a fully fiat currency:

Not surprisingly, Bundesbank officials are attempting to smooth over German concerns about their gold reserves, with board member Thiele snidely remarking that he took a look inside of one of the vaults at the NY Fed recently, and “There was no paper in there, just gold.“:

While Bundesbank officials likely understand the reality (much better than German politicians do) that a German repatriation of it’s entire 1,536 tons of gold reserves held at the NY Fed would likely cause a complete Western financial collapse if/when the Fed failed to promptly deliver said gold (tungsten free), confidence in the Fed and the BOE has clearly been shattered, and it is now only a matter of time for an absolute mad run on every last gram of physical metal underneath the NY Fed ensues.

Got PHYZZ??

Check out these similar articles:

Filed Under: Uncategorized Tagged With: Ben Bernanke, Bundesbank, german gold reserves, gold leasing, gold repatriation, NY Fed

November 22, 2012 By The Doc 92 Comments

Tweet

Calls for Germany to repatriate its 1,536 tons of gold reserves held at the NY Fed are intensifying as Der Spiegel reports the Federal Reserve has refused to allow German inspectors to even view the country’s massive gold reserves “in the interest of security and of the control process“.

Calls for Germany to repatriate its 1,536 tons of gold reserves held at the NY Fed are intensifying as Der Spiegel reports the Federal Reserve has refused to allow German inspectors to even view the country’s massive gold reserves “in the interest of security and of the control process“.We have stated repeatedly that with repatriation and/or audit requests completed or in progress by Venezuela, Germany, Switzerland, and the Netherlands, The BOE and the Fed suddenly find themselves in a heap of trouble as the situation (and confidence that the Central banks actually still hold the tungsten gold reserves on deposit) is rapidly deteriorating.

More on the Fed’s non-compliance with German requests to view/inspect their own gold below.

Der Spiegel reports that nearly half of Germany’s entire gold reserves are still held (supposedly) 5 floors below the NY Fed:

The Fed has reportedly denied German requests to view their own gold reserves, ‘in the interest of security’:

The Federal Reserve Bank of New York continues to hold 1,536 metric tons of German gold — or nearly half of Berlin’s reserves. This enormous hoard of gold is stored in the fifth subfloor of the bank’s building on Liberty Street, 25 meters (80 feet) below street level, and 15 meters below sea level. According to the bank’s website, the vault rests on the bedrock of Manhattan Island.

Tourists are allowed to venture below street level to see the vault. After descending in an elevator, they stand in front of an enormous steel cylinder that pivots like a door in a 140-ton steel-and-concrete frame. But not even the owners are allowed to view their own gold. According to the Federal Audit Office report, the Fed explained that “in the interest of security and of the control process” no “viewings” are possible.

Of the 9 compartments supposedly storing German gold, German officials were finally allowed to briefly view a few bars from a single compartment in 2011:

Finally, in 2007, “following numerous enquiries,” Bundesbank staff members were allowed to see the facility, but they reportedly only made it to the anteroom of the German reserves.

In fact, auditors from the Bundesbank made a second visit in May 2011. This time one of the nine compartments was also opened, in which the German gold bars are densely stacked. A few were pulled out and weighed. But this part of the report has been blacked out — out of consideration for the Federal Reserve Bank of New York.

Unlike the US financial MSM, the German media is willing to discuss not only the question of whether the Federal Reserve has absconded with Germany’s gold, but also the risk of a collapse of a fully fiat currency:

The debate over a collapse of strictly paper-based currency is experiencing a renaissance — as is the dispute over the gold reserves. Even Green Party financial expert Gerhard Schick has joined the fray: “I think the question of how much gold is available in an emergency is a valid concern.”

Not surprisingly, Bundesbank officials are attempting to smooth over German concerns about their gold reserves, with board member Thiele snidely remarking that he took a look inside of one of the vaults at the NY Fed recently, and “There was no paper in there, just gold.“:

The Bundesbank also objects to this notion for another reason. It says the gold is supposed to act as an emergency buffer. In the extreme situation of a currency collapse, the bankers say that the gold bars could easily and quickly be exchanged on location for pounds or dollars to pay urgent bills.

In a bid to calm the debate, the Bundesbank has pledged to bring back and inspect 150 tons of gold from abroad over the next three years. Furthermore, there are plans to count and weigh the gold bars stored in one of the nine chambers at the Fed in New York — although no date has been set for this.

Bundesbank board member Thiele was also recently in New York where he took a look behind one of the vault doors. He had good news for the members of the parliamentary budget committee: “There was no paper in there, just gold.”

While Bundesbank officials likely understand the reality (much better than German politicians do) that a German repatriation of it’s entire 1,536 tons of gold reserves held at the NY Fed would likely cause a complete Western financial collapse if/when the Fed failed to promptly deliver said gold (tungsten free), confidence in the Fed and the BOE has clearly been shattered, and it is now only a matter of time for an absolute mad run on every last gram of physical metal underneath the NY Fed ensues.

Got PHYZZ??

Check out these similar articles:

- German Parliament Denied Access to Inspect German Gold Reserves Due to ‘Lack of Visiting Rooms’

- Bundesbank Says NY Fed to Help Meet Gold Audit Request

- GERMANY TO REPATRIATE & AUDIT 150 TONS OF GOLD RESERVES FROM NY FED!!!

- James Turk With Lauren Lyster on the Overestimated Gold Stock, German Repatriation, and an EU Crisis!

- Bundesbank Makes Official Statement on Gold Reserves: Gold Must Be Held Abroad for Liquidity

Filed Under: Uncategorized Tagged With: Ben Bernanke, Bundesbank, german gold reserves, gold leasing, gold repatriation, NY Fed

Panda- Platinum Poster

-

Number of posts : 30555

Age : 67

Location : Wales

Warning :

Registration date : 2010-03-27

Re: Bl***y Banks Again

Re: Bl***y Banks Again

I remember years ago when I was working in a Bank being told that the Gold Germany sent to Fort Knox during the War was no longer there.

All the gold did not belong to the Germans, many Jews had Gold Bars stored in various German Banks.

This is a dreadful scandal and another reason why Governments are so corrupt.

As far back as the 17th Century in Britain gold was debased and how the term "quantitive easing" was born..

All the gold did not belong to the Germans, many Jews had Gold Bars stored in various German Banks.

This is a dreadful scandal and another reason why Governments are so corrupt.

As far back as the 17th Century in Britain gold was debased and how the term "quantitive easing" was born..

Panda- Platinum Poster

-

Number of posts : 30555

Age : 67

Location : Wales

Warning :

Registration date : 2010-03-27

Re: Bl***y Banks Again

Re: Bl***y Banks Again

UBS Libor Manipulation Deserves the Death Penalty

ByWilliam D. CohanDec 23, 2012 11:31 PM GMT

There is no point in mincing words: UBS AG (UBSN), the Swiss global bank, has been disgracing the banking profession for years and needs to be shut down.

The regulators that allow it to do business in the U.S. -- the Federal Reserve, the Securities and Exchange Commission, the Commodity Futures Trading Commission and the Office of Comptroller of the Currency -- should see that the line in the sand was crossed last week. On Dec. 19, the bank paid $1.5 billion to global regulators -- including $700 million paid to the CFTC, the largest fine in the agency’s history -- to settle claims that for six years, the company’s traders and managers, specifically at its Japanese securities subsidiary, manipulated the London interbank offered rate and other borrowing standards.

About William D Cohan»

William D. Cohan is the author of the recently released "Money and Power: How Goldman Sachs Came to Rule the ...MORE

FOLLOW ON TWITTER

More from William D Cohan:

Libor is a benchmark index rate, off which trillions of dollars of loans are priced on a daily basis. According to the Wall Street Journal, two of the many victims of the Libor fraud -- a scandal that so far has nabbed Barclays Plc and UBS but will probably include other large global banks -- were the quasi-federal housing agencies Fannie Mae and Freddie Mac, which together claim to have lost more than $3 billion as a result of the manipulation.

The same day of UBS’s global settlement, which included the Japanese subsidiary pleading guilty to fraud, two former UBS traders, Tom Hayes and Roger Darin, were sued by the Justice Department and charged with “conspiring to manipulate” Libor.

Benchmark Manipulation

“The alleged conspirators we’ve charged -- along with others at UBS -- manipulated the benchmark interest rate upon which many transactions and consumer financial products are based,” Attorney General Eric Holder said in a statement. “They defrauded the company’s counterparties of millions of dollars. And they did so primarily to reap increased profits, and secure bigger bonuses, for themselves.”

To see the level to which UBS employees descended, one need look no further than their written communications, as per U.S. prosecutors’ document dump. “Mate yur getting bloody good at this libor game,” one broker told a UBS derivatives trader. “Think of me when yur on yur yacht in monaco wont yu.”

But, then again, UBS and bad behavior have become nearly synonymous. During the financial crisis, UBS took writedowns totaling some $50 billion, prompting the company to produce a 76-page, single-spaced, Orwellian transparency report. “In the aftermath of the financial market crisis it was revealed,” the report said, “that UBS had taken a serious turn in the wrong direction under the leadership of the senior management then in charge of the bank. The result was an enormous loss of trust.”

In February 2009, UBS entered into a deferred-prosecution agreement with the Justice Department and admitted to helping American taxpayers defraud the Internal Revenue Service. UBS agreed to provide the names of some clients whom it had helped to avoid U.S. taxes and to pay a fine of $780 million.

Then, last month, came the conviction of former UBS “rogue” trader, Kweku Adoboli, on charges that he hid trading losses totaling more than $2.3 billion. The U.K.’s Financial Services Authority fined UBS some $47 million and charged that its oversight of London traders was too trusting. The bank seems more than a little out of control.

The latest example of the bank’s shameful behavior can be found in the false bravado of the traders who for years manipulated Libor and thought they could get away with it. The gruesome details can be found in the Dec. 19 report from Britain’s Financial Services Authority.

‘Wash Trades’

It found that unidentified UBS traders entered into “wash trades” -- described as “risk-free trades that canceled each other out” and had no commercial rationale -- in order to “facilitate corrupt brokerage payments” to three individual brokers at two other firms.

In a Sept. 18, 2008, telephone conversation, Hayes promised that if one broker kept the six-month Japanese yen Libor unchanged for the day, he would in exchange “pay you, you know, 50,000 dollars, 100,000 dollars ... whatever you want ... I’m a man of my word.” Lovely.

We also find out that a year earlier, Hayes had a chat on his Bloomberg terminal with Darin in which he pushed to find out what rate for Japanese yen Libor UBS would submit to the governing body that set the rates. “Too early to say yet,” Darin replied, before estimating that 0.69 percent “would be our unbiased contribution.”

Hayes repeated his request for a “low” submission on the three-month Japanese yen Libor. Darin messaged back: “as i said before - i dun mind helping on your fixings, but i’m not setting libor 7 [basis points] away from the truth i’ll get ubs banned if i do that, no interest in that.” Darin eventually submitted a Libor rate two basis points less than the “unbiased” figure of 0.69 percent.

In levying the record $700 million fine, David Meister, the CFTC’s director of enforcement, said that “when a major bank brazenly games some of the world’s most important financial benchmarks, the CFTC will respond with the full force of its authority.” That’s good as far as it goes, and the CFTC is to be commended for rooting out the global Libor manipulation scandal.

But an even more emphatic message needs to be sent to UBS by its prudential regulator in the U.S.: You are finished in this country. We are padlocking your Stamford, Connecticut, and Manhattan offices. You need to pack up and leave. Now.

(William D. Cohan, the author of “Money and Power: How Goldman Sachs Came to Rule the World,” is a Bloomberg View columnist. He was formerly an investment banker at Lazard Freres, Merrill Lynch and JPMorgan Chase. The opinions expressed are his own.)

ByWilliam D. CohanDec 23, 2012 11:31 PM GMT

There is no point in mincing words: UBS AG (UBSN), the Swiss global bank, has been disgracing the banking profession for years and needs to be shut down.

The regulators that allow it to do business in the U.S. -- the Federal Reserve, the Securities and Exchange Commission, the Commodity Futures Trading Commission and the Office of Comptroller of the Currency -- should see that the line in the sand was crossed last week. On Dec. 19, the bank paid $1.5 billion to global regulators -- including $700 million paid to the CFTC, the largest fine in the agency’s history -- to settle claims that for six years, the company’s traders and managers, specifically at its Japanese securities subsidiary, manipulated the London interbank offered rate and other borrowing standards.

About William D Cohan»

William D. Cohan is the author of the recently released "Money and Power: How Goldman Sachs Came to Rule the ...MORE

FOLLOW ON TWITTER

More from William D Cohan:

- Benevolent Billionaires Should Buy Out Bushmaster

Q - Smart Money Is on Geithner to Replace Bernanke

Q - Citigroup’s Amazing Abu Dhabi Adventure

Q

Libor is a benchmark index rate, off which trillions of dollars of loans are priced on a daily basis. According to the Wall Street Journal, two of the many victims of the Libor fraud -- a scandal that so far has nabbed Barclays Plc and UBS but will probably include other large global banks -- were the quasi-federal housing agencies Fannie Mae and Freddie Mac, which together claim to have lost more than $3 billion as a result of the manipulation.

The same day of UBS’s global settlement, which included the Japanese subsidiary pleading guilty to fraud, two former UBS traders, Tom Hayes and Roger Darin, were sued by the Justice Department and charged with “conspiring to manipulate” Libor.

Benchmark Manipulation

“The alleged conspirators we’ve charged -- along with others at UBS -- manipulated the benchmark interest rate upon which many transactions and consumer financial products are based,” Attorney General Eric Holder said in a statement. “They defrauded the company’s counterparties of millions of dollars. And they did so primarily to reap increased profits, and secure bigger bonuses, for themselves.”

To see the level to which UBS employees descended, one need look no further than their written communications, as per U.S. prosecutors’ document dump. “Mate yur getting bloody good at this libor game,” one broker told a UBS derivatives trader. “Think of me when yur on yur yacht in monaco wont yu.”

But, then again, UBS and bad behavior have become nearly synonymous. During the financial crisis, UBS took writedowns totaling some $50 billion, prompting the company to produce a 76-page, single-spaced, Orwellian transparency report. “In the aftermath of the financial market crisis it was revealed,” the report said, “that UBS had taken a serious turn in the wrong direction under the leadership of the senior management then in charge of the bank. The result was an enormous loss of trust.”

In February 2009, UBS entered into a deferred-prosecution agreement with the Justice Department and admitted to helping American taxpayers defraud the Internal Revenue Service. UBS agreed to provide the names of some clients whom it had helped to avoid U.S. taxes and to pay a fine of $780 million.

Then, last month, came the conviction of former UBS “rogue” trader, Kweku Adoboli, on charges that he hid trading losses totaling more than $2.3 billion. The U.K.’s Financial Services Authority fined UBS some $47 million and charged that its oversight of London traders was too trusting. The bank seems more than a little out of control.

The latest example of the bank’s shameful behavior can be found in the false bravado of the traders who for years manipulated Libor and thought they could get away with it. The gruesome details can be found in the Dec. 19 report from Britain’s Financial Services Authority.

‘Wash Trades’

It found that unidentified UBS traders entered into “wash trades” -- described as “risk-free trades that canceled each other out” and had no commercial rationale -- in order to “facilitate corrupt brokerage payments” to three individual brokers at two other firms.

In a Sept. 18, 2008, telephone conversation, Hayes promised that if one broker kept the six-month Japanese yen Libor unchanged for the day, he would in exchange “pay you, you know, 50,000 dollars, 100,000 dollars ... whatever you want ... I’m a man of my word.” Lovely.

We also find out that a year earlier, Hayes had a chat on his Bloomberg terminal with Darin in which he pushed to find out what rate for Japanese yen Libor UBS would submit to the governing body that set the rates. “Too early to say yet,” Darin replied, before estimating that 0.69 percent “would be our unbiased contribution.”

Hayes repeated his request for a “low” submission on the three-month Japanese yen Libor. Darin messaged back: “as i said before - i dun mind helping on your fixings, but i’m not setting libor 7 [basis points] away from the truth i’ll get ubs banned if i do that, no interest in that.” Darin eventually submitted a Libor rate two basis points less than the “unbiased” figure of 0.69 percent.

In levying the record $700 million fine, David Meister, the CFTC’s director of enforcement, said that “when a major bank brazenly games some of the world’s most important financial benchmarks, the CFTC will respond with the full force of its authority.” That’s good as far as it goes, and the CFTC is to be commended for rooting out the global Libor manipulation scandal.

But an even more emphatic message needs to be sent to UBS by its prudential regulator in the U.S.: You are finished in this country. We are padlocking your Stamford, Connecticut, and Manhattan offices. You need to pack up and leave. Now.

(William D. Cohan, the author of “Money and Power: How Goldman Sachs Came to Rule the World,” is a Bloomberg View columnist. He was formerly an investment banker at Lazard Freres, Merrill Lynch and JPMorgan Chase. The opinions expressed are his own.)

Panda- Platinum Poster

-

Number of posts : 30555

Age : 67

Location : Wales

Warning :

Registration date : 2010-03-27

Re: Bl***y Banks Again

Re: Bl***y Banks Again

A SWISS BANK CALLED WEIENLER? HAS GONE INTO LIQUATION AFTER FLOUTING US LAW(THEY HELPED US CITIZENS ESCAPE TAXES)

Badboy- Platinum Poster

-

Number of posts : 8857

Age : 58

Warning :

Registration date : 2009-08-31

Re: Bl***y Banks Again

Re: Bl***y Banks Again

Badboy wrote:A SWISS BANK CALLED WEIENLER? HAS GONE INTO LIQUATION AFTER FLOUTING US LAW(THEY HELPED US CITIZENS ESCAPE TAXES)

Harry Redknaps dogs going to be upset.

Lioned- Platinum Poster

- Number of posts : 8554

Age : 115

Location : Down South

Warning :

Registration date : 2009-08-30

Re: Bl***y Banks Again

Re: Bl***y Banks Again

BANKS HAVE FALLEN VICTIM TO A 750 MILLION FRAUD(ANGLO-IRISH BANK ETC),SO A UK COURT HAS HEARD

Badboy- Platinum Poster

-

Number of posts : 8857

Age : 58

Warning :

Registration date : 2009-08-31

Re: Bl***y Banks Again

Re: Bl***y Banks Again

Badboy wrote:BANKS HAVE FALLEN VICTIM TO A 750 MILLION FRAUD(ANGLO-IRISH BANK ETC),SO A UK COURT HAS HEARD

Yes and the perpetrators only got about a 5 year stretch !

Lioned- Platinum Poster

- Number of posts : 8554

Age : 115

Location : Down South

Warning :

Registration date : 2009-08-30

Page 17 of 37 •  1 ... 10 ... 16, 17, 18 ... 27 ... 37

1 ... 10 ... 16, 17, 18 ... 27 ... 37

Similar topics

Similar topics» Even the Vatican has trouble with Banks!!!

» BL**DY BANKS !!

» $70 billion withdrawn from Russian Banks

» EU wants an extra £1.7 billion payment from U.K.

» ASSANGE INTERVIEW RE BANKS

» BL**DY BANKS !!

» $70 billion withdrawn from Russian Banks

» EU wants an extra £1.7 billion payment from U.K.

» ASSANGE INTERVIEW RE BANKS

Page 17 of 37

Permissions in this forum:

You cannot reply to topics in this forum